IFRS and Crypto assets Cryptocurrencies and Tokens

Many entities classify crypto assets according to their characteristic features trying to accommodate existing standards and regulations.

Classification

- Cryptocurrencies – “currency” designed to function as a medium of exchange such as Bitcoin; Value is derived based on supply and demand;

- Utility tokens – Many of these tokens come from the ICOs and have mainly been used to raise funds for the future projects on Blockchain. It grants the holders access/right to specific products or services; Value is derived from the demand for the issuer’s service or product;

- Security tokens –There are usually no physical assets involved and the tokens are exchanged via contracts between parties. They are similar to securities such as shares or bonds, that provide an economic stake or right in a legal entity to receive cash or another financial asset; Value depends on the success of the company;

- Natural asset tokens – There have been a large number of tokens where they are backed by natural physical assets, such as gold or oil. The token is used to transfer this value and settle the trade.

Value is derived based on the underlying asset;

WE now have a basic understanding what crypto assets are and how they are defined; When it comes to accounting much judgement and considerations are required by auditors as IFRS does not include specific guidance on the accounting for crypto assets. The purpose of the entity for holding crypto asset is key to correct accounting.

Non-applicable standards should be excluded, before discussing accounting of cryptocurrencies and tokens.

As defined in IAS7 and IAS32 cryptocurrencies and Tokens cannot be considered equivalent to cash due to the following reasons:

- it is not widely accepted or used as the monetary unit in pricing goods or services;

- they are subject to significant price volatility;

Let’s split the holding of Cryptocurrencies into two parts:

- held for trading (usually selling within less than a year);

- held for value creation (storing);

In certain circumstances it depends on a specific business model, weather cryptocurrencies can be accounted according to IAS2 or not. for example the entity holding cryptocurrencies for sale in the ordinary course of business, not for capital appreciation, most probably would apply for recognition and measurement of IAS2.

In the second scenario CRYPTOCURRENCIES are held for value creation. IAS38 is applied when the asset is identifiable without any physical substance having the probability of future economic benefits.

In case of Tokens, except for IAS38 and IAS2, prepaid assets accounting might also be applied as tokens are similar to prepayments for future goods or services. In addition when it comes to asset-backed (depending on the type of underlying asset) tokens it might also meet the definition of a financial asset providing a holder with a right to deliver or receive cash or another financial instrument.

MARI TSUTSKIRIDZE

Invited Advisor

Double-degree MBA, IIBA and ACCA Affiliate, CBAP® Candidate

Mobile: (+995) 599 018101

Email: info@innox.ge

20 February 2021

© 2021 INNOX LLC. All rights reserved

Blockchain Technology Prerequisites, Benefits and Challenges

There is much bias and misunderstanding about what Blockchain technology really is and how it works. I would start with the very basics of the Blockchain, that doesn’t require any prior technical knowledge.

At its most simple way, Blockchain is an electronic file used to store mathematically encrypted information in a tamper-proof form and chronological order. It resides on a digital storage media, similar to hard drive, taking the form of a string of binary, ones and zeros, which can be easily processed by computers and then interpreted by humans.

Blockchain has some key attributes, while putting them all together underlines the uniqueness of the technology.

- Distributed ledger – digital file stored in one place and shared, not copied across many devices;

- Immutability – inability to modify Blockchain’s distributed ledger, that prevents ‘double spending’ for all users;

- Accessibility – system ‘accessible to anyone’ or ‘accessible to anyone who has been given permission to view it’;

| BLOCKCHAIN KEY ATTRIBUTES |

BLOCKCHAIN |

| Distributed Ledger |

IMMUTABILITY |

Accessibility |

Structure

- Public

the rules are consensus-based. there is no single owner of the data: everyone who has access to the data is an owner. Joining the network and adding transactions to the ledger is possible while having computer on which the relevant software has been installed;

- Private

access is given exclusively to a defined community of known and trusted users, where sometimes an authority can be designated for setting the rules and giving out permissions.

- Consortium

Members agree upon certain aspects, for example, what protocol (rules) to use, selecting initial membership list, etc. this kind of Blockchain mainly requires Systematic open interaction, idea exchange, sometimes independent facilitation and a strong, distributed governance.

“Modern seismic shifts utilize great potential of BLOCKCHAIN, only where it is viable and useful.” |

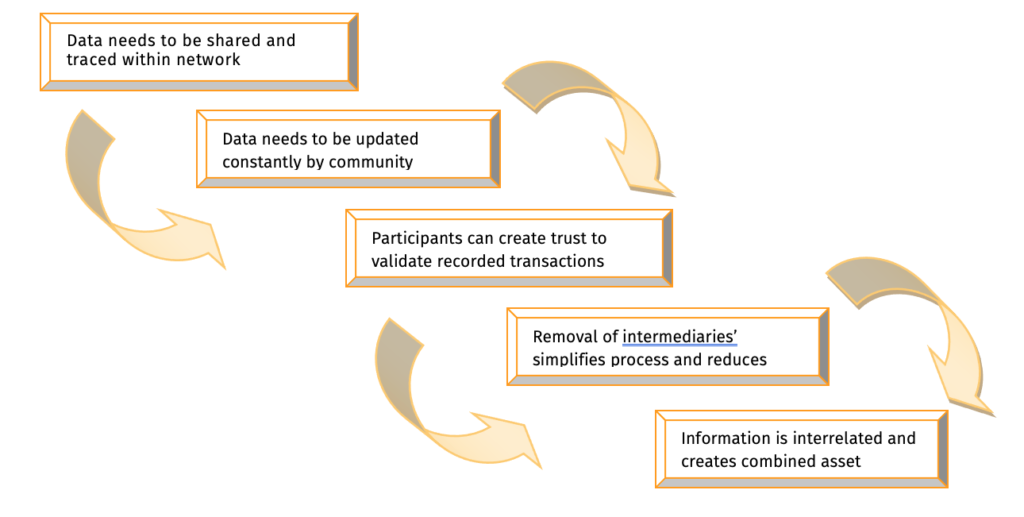

Prerequisites

| Data needs to be shared and traced within network |

If following steps are met during assessment stage then company should start drafting Blockchain strategy.

| BLOCKCHAIN PREREQUISITES |

| Data needs to be updated constantly by community members |

| Participants can create trust to validate recorded transactions |

| Removal of intermediaries’ simplifies process and reduces costs |

| Information is interrelated and creates combined asset |

Benefits, Challenges, Recommendations

Benefits of the technology depend on the industry where it is applied, though improved traceability, trust, security, transparency, speed and efficiency are advantages in common.

Building fully committed community due to different levels of digital readiness and the initial requirement to recognize the mutual benefits of Blockchain-based collaboration considers to be one of the important factors to enable Blockchain.

The first challenge, in countries similar to the republic of georgia, is the need of continued awareness raising; the second challenge is technical and pertains to interoperability, defined as communicating and exchanging information and value between different Blockchain protocols. Achieving this goal requires embracing the open source movement, agreeing common standards and establishing trusted Blockchain, all of which are complex problems to overcome.

Blockchain implementation without involvement of Governmental force will take a lot more time and financial recourses. Blockchain consortium creation and extensive involvement of Government will play a pivotal role to foster innovation. In order to regulate Blockchain on a large-scale pattern, government should first invest in technology understanding. Next, actively support the development of technical standards. And finally, make it possible to set up small-scale demonstration projects for Blockchain ventures.

MARI TSUTSKIRIDZE

Invited Advisor

Double-degree MBA, IIBA and ACCA Affiliate, CBAP® Candidate

Mobile: (+995) 599 018101

Email: info@innox.ge

15 February 2021

© 2021 INNOX LLC. All rights reserved